؛̖(h��o)��

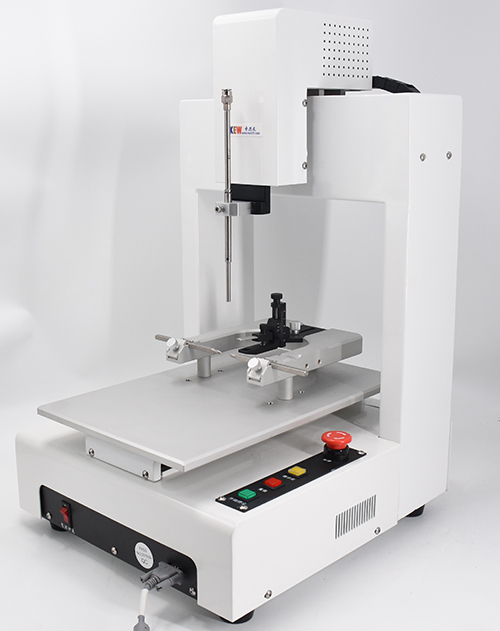

؛̖(h��o)��JB-MZJ-4

؛̖(h��o)��

؛̖(h��o)��JB-CZX

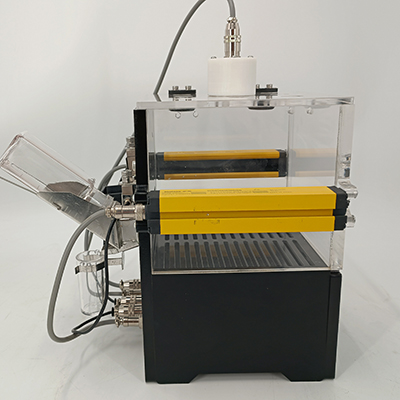

؛̖(h��o)��JB-RB

؛̖(h��o)��JB-100

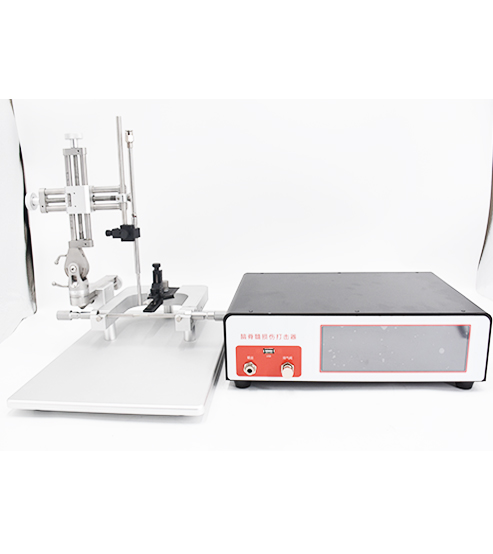

؛̖(h��o)��JB-MZJ

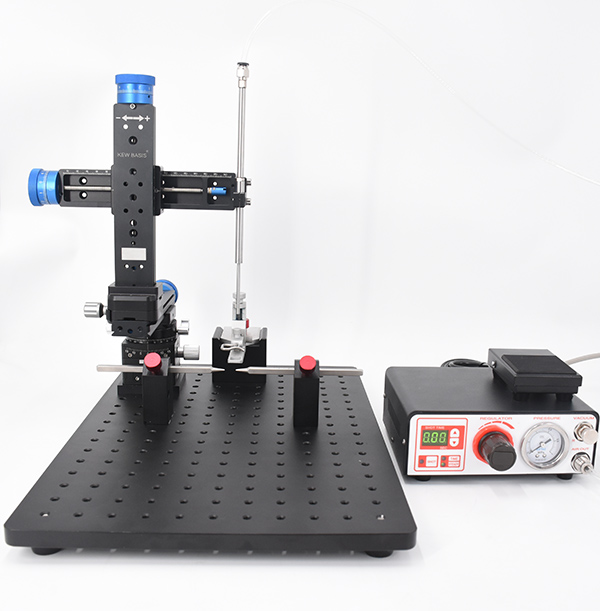

؛̖(h��o)��JB-LB

؛̖(h��o)��JB-DC

؛̖(h��o)��JB-PT

؛̖(h��o)��JB-10

؛̖(h��o)��JB-CT

؛̖(h��o)��

؛̖(h��o)��

؛̖(h��o)��

؛̖(h��o)��

؛̖(h��o)��

؛̖(h��o)��

؛̖(h��o)��

؛̖(h��o)��

؛̖(h��o)��

؛̖(h��o)��

؛̖(h��o)��

؛̖(h��o)��

؛̖(h��o)��

؛̖(h��o)��

؛̖(h��o)��

؛̖(h��o)��

؛̖(h��o)��

؛̖(h��o)��

؛̖(h��o)��JB-SJN

؛̖(h��o)��

؛̖(h��o)��

؛̖(h��o)��JB-6C

؛̖(h��o)��KW-XFY

؛̖(h��o)��JB-35

���d��...

���d��...